malaysia payroll tax

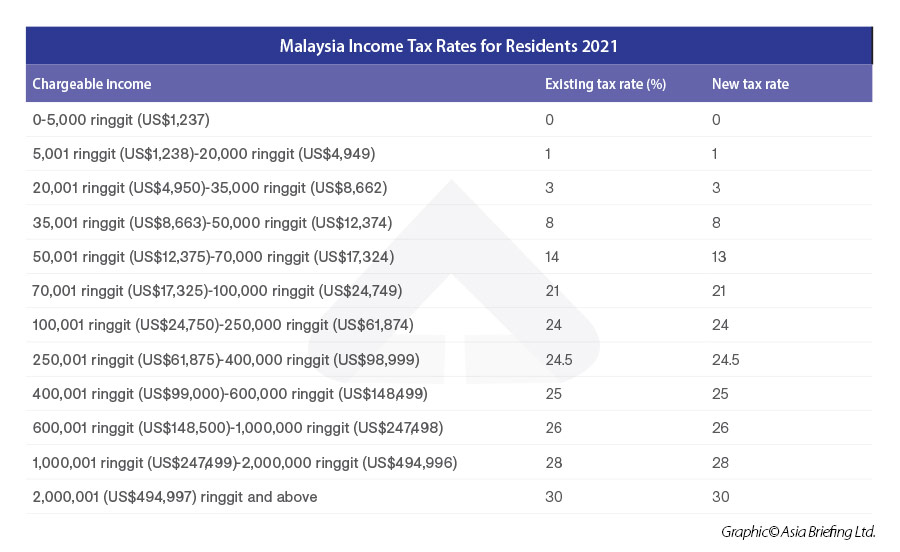

All tax residents as well as non-residents employees who work between 60-182 days per year in Malaysia are required to pay tax capped at 30 for income more than MYR 2000000. However most of the business owner are not aware of their responsibility under Malaysia rules and regulations.

What You Need To Know About Payroll In Malaysia

It won the Best Payroll Software award trusted by Fortune 500 and multinational corporations across Asia Australia Middle East Africa United Kingdom and more.

. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Calculate monthly tax deduction 2022 for Malaysia Tax Residents. Third Schedule Part A of the EPF Act 1991 Age Group 60 75 years and below.

Tax Rates in Malaysia. 5 to 9 Malaysian employees. 13 rows Understanding Payroll Tax in Malaysia In Malaysia a monthly tax deduction MTD system.

Many of the available deductions may not have been included in the MTD and so the employee might be entitled to a refund at year end. Minimum of 11 of the employees monthly wages. The highest rate of tax on personal income is 30 which is the rate for income exceeding MYR 2000000.

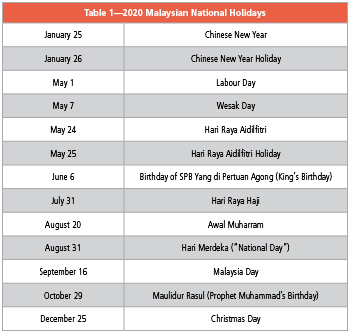

Payment for overtime worked on public holidays is paid at a rate of 30000 of the regular salary rate. The tax year in Malaysia runs from 1st January to 31st of December. Employees who work between 60182 days per year in Malaysia are considered non-residents irrespective of their actual citizenship status.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Income tax rates.

The Act states that overtime hours during the week on a working day are paid at 15000 of the regular salary rate and overtime hours worked on rest days and weekends are paid at 20000 of the regular salary rate. The fiscal year in Malaysia starts from 1st January to 31st December. The personal income tax rates in Malaysia range from 0-26 based on overall compensation minus deductions.

05 of the monthly wages of each of their Malaysian employees. Ramco is considered the best payroll software in Malaysia and other parts of the world. Overview of payroll requirements Tax.

Some of the common rules and regulations that employers need to comply during payroll computation are. Malaysias financial year runs from 1 st January to 31 st. 13 rows Malaysian ringgit.

A Monthly wages RM5000 and below Minimum of 13 of the employees monthly wages. Tax for Non-Residents is currently a flat 30 whereas tax for residents is on a sliding scale from 0 to 30 dependent on which income grouping you fall into. Payroll is a basic necessity for any business you have to pay your employees make the correct deductions and file taxes.

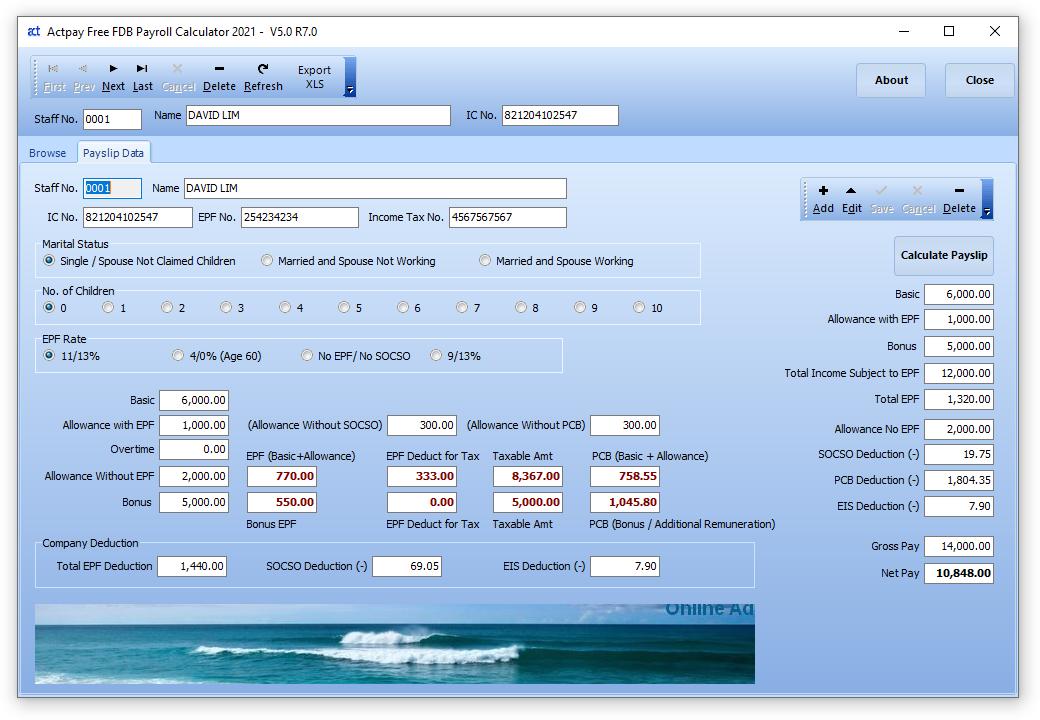

For more information on which allowances to include in the calculation please read here. B Monthly wages exceed RM 5000 Minimum 12 of the employees monthly wages. All employees in Malaysia should be issued with a payslip when they are paid including information such as wages earned and deductions made.

Companies in Malaysia should withhold income tax payments at source from employees under a Pay-As-You-Earn PAYE system although employees are still required to complete self-assessments each year. The maximum income tax rate in Malaysia is 30 which applies to those with incomes greater than MYR 2000000 or non-residents. Malaysia follows a progressive tax rate from 0 to 28.

Each employee will need to file their taxes for each calendar year before 30th April. Typically for an average paid worker residence tax is at 14. 1 of the monthly wages of each of their Malaysian employees.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. Regardless of residency or citizenship all workers in Malaysia are required to pay tax.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Monthly tax deductions in Malaysia are governed by the STD mechanism - which reduces the need for employees to pay tax in one lump sum.

Malaysia Income Tax For Residents 2021 Asean Business News

Cukai Pendapatan How To File Income Tax In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Do Pcb Calculator Through Payroll System Malaysia

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Free Payroll Software For Sme S Malaysia

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Payroll And Tax Activpayroll

Malaysia Income Tax Guide 2016 Ringgitplus Com

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysian Tax Issues For Expats Activpayroll

Business Income Tax Malaysia Deadlines For 2021

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

0 Response to "malaysia payroll tax"

Post a Comment